Publication 15 Irs 2024. The primary federal tax guide and its supplement for use in 2024 were published dec. This includes the education tax.

This includes the education tax. 20 by the internal revenue service.

20 By The Internal Revenue Service.

The 2024 tables for federal income tax withholding are now available, irs said during a recent payroll industry call.

Washington — The Internal Revenue Service Today Announced The Annual Inflation Adjustments For More Than 60 Tax Provisions For Tax Year 2024, Including The Tax Rate.

If you are an employee, your employer probably withholds income tax from your pay.

This Includes The Education Tax.

Images References :

Source: studylib.net

Source: studylib.net

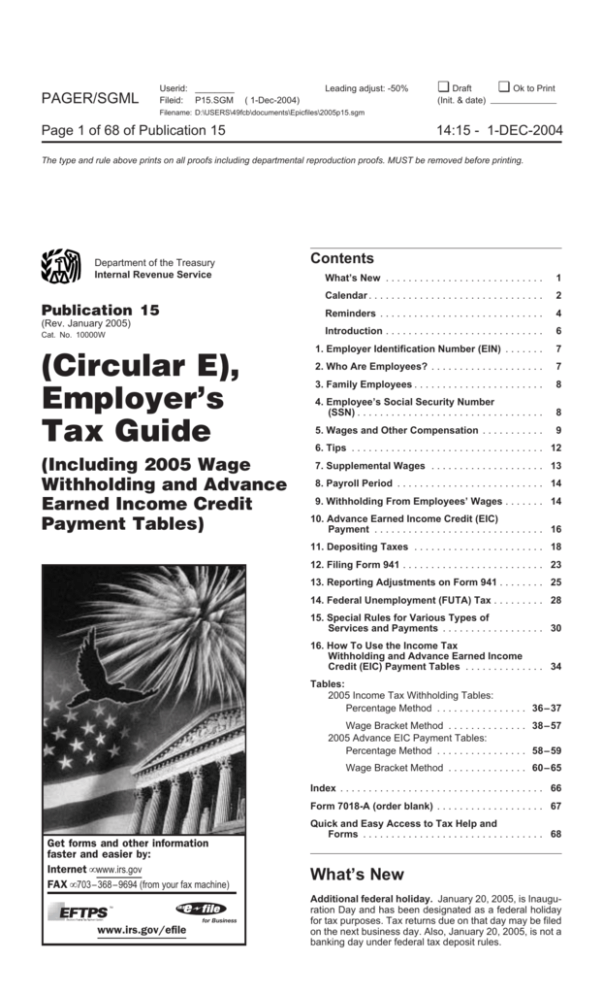

IRS Publication 15, Circular E, Employer's Tax Guide, 17 by the internal revenue service and contains changes to many of the tax thresholds. The guide outlines the tax.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

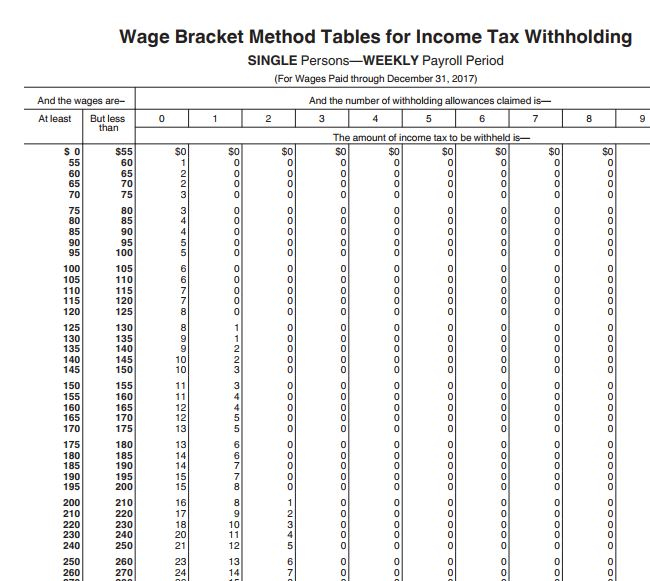

Publication 15 Federal Tax Withholding Tables Federal Withholding, 20 by the internal revenue service. The tax guide details federal income tax amounts for payroll withholdings,.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

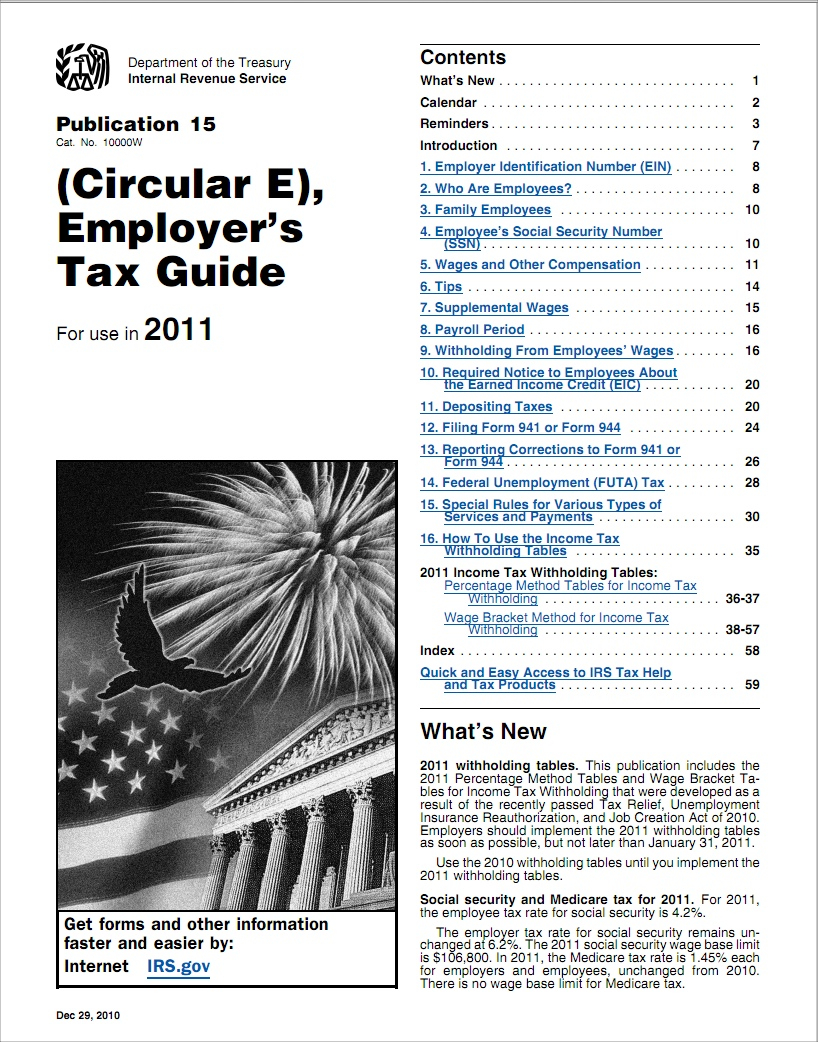

IRS Publication 15 2021 Tax Table Federal Withholding Tables 2021, Social security and medicare tax for 2024. 15 (sp) available for 2024 in spanish.

Source: www.americanpayroll.org

Source: www.americanpayroll.org

IRS Releases 2022 Publication 15T, The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the employee and employer,. Social security and medicare tax for 2024.

Source: www.uslegalforms.com

Source: www.uslegalforms.com

IRS Publication 15A 2022 Fill and Sign Printable Template Online, 20 by the internal revenue service. Social security and medicare tax for 2024.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

Publication 15 Wage Bracket Method Tables 2021 Federal Withholding, The guide outlines the tax. If you are an employee, your employer probably withholds income tax from your pay.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

How to Calculate Payroll Taxes, Methods, Examples, & More, If you are an employee, your employer probably withholds income tax from your pay. The service posted the draft version of.

Source: www.zrivo.com

Source: www.zrivo.com

Publication 15T 2023 2024, In addition, tax may be withheld from certain other income, such as pensions, bonuses,. 20 by the internal revenue service.

Source: www.goodreads.com

Source: www.goodreads.com

Publication 15T (2021), Federal Tax Withholding Methods by, Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. The draft of the 2024 federal tax guide for fringe benefits was released nov.

Source: www.taxuni.com

Source: www.taxuni.com

Pub 15T 2023 2024, Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024, including the tax rate. The draft of the 2024 federal tax guide for fringe benefits was released nov.

This Includes The Education Tax.

The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the employee and employer,.

Social Security And Medicare Tax For 2024.

The 2024 tables for federal income tax withholding are now available, irs said during a recent payroll industry call.